Fannie Mae 3735 2021-2025 free printable template

Get, Create, Make and Sign loan agreement construction sample form

Editing fannie mae construction loan agreement online

Fannie Mae 3735 Form Versions

How to fill out fannie mae form construction

How to fill out Fannie Mae 3735

Who needs Fannie Mae 3735?

Video instructions and help with filling out and completing construction loan agreement

Instructions and Help about loan contractor form

Hi this is Rick with California construction loans calm and in this video we're going to show you how to fill out a standard loan application or as we call it a standard 1003 loan application again you can always access the download or download the application package by clicking on the icon here on the home page at California construction once calm I've already inputted the password to access this package remember the password is home h on e that's the password to get access to this information, and we kept it really simple, so it's easy to remember I'm going to open up this standard 10030 application which I've already done that right here, so this is the standard uniform residential loan application and the things I'm going to point out here are just simply the most important things the loan amount that is simply a guesstimate at this point your let's say you think the loan amount is going to be $500,000 then you would want to write that in there the subject property address is simply where you're building your land address and the next item you want to check off is whether this is a construction a permanent loan or just you know a construction only loan and whether it's your primary residence secondary residence or investment this line right here is important to fill out the year you bought the property the original cost in other words what you paid for it the amount of existing liens on the property if any and the value of the property as it currently sits if you've spent money on well septic water sewer cost of improvements you put that number in here and then total it up and again the other items are really not that important at this time you always want to make sure you put your name social security number and as legible as possible we get sometimes to get applications where we can barely read the social, and it just simply doesn't allow us to do a pre-qualification, so that's very important right there your employer information you always want to make sure you got the job title in there how many years you've been working at that particular job the address those are important items that sometimes we find missing as far as income you want to put your monthly gross income, so sometimes we get applications where the customer put they need the yearly income and set up the monthly so make sure you put the monthly in there, and it's sometimes a little confusing most times we can figure that out if you're currently renting or your current mortgage your present address you just put that into this section and propose we can figure that out for you once we do a pre-qualification this has become probably the most important part of an application which is your assets liquid assets such as your checking savings 401k, so you put checking maybe here savings here so on and so forth the other liquid assets that's very important is the vested interest in your retirement fund, so those numbers right there are very important for us to make sure that you...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form construction loan agreement?

Can I sign the construction loan disbursement form electronically in Chrome?

How do I edit 3735 construction loan on an iOS device?

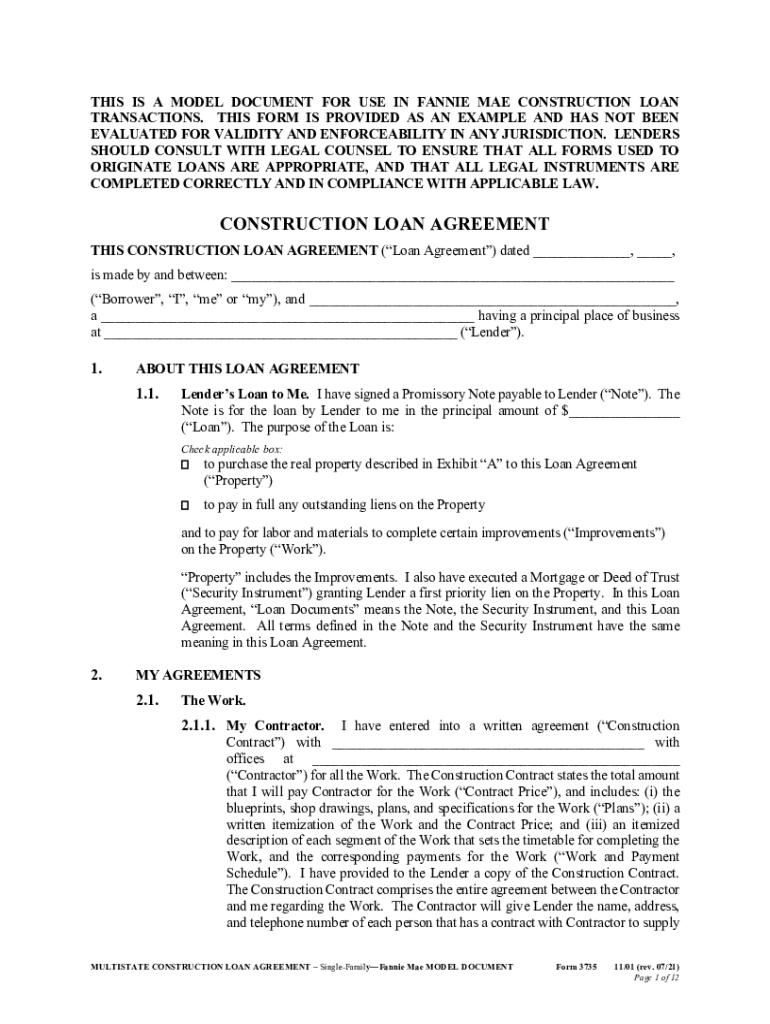

What is Fannie Mae 3735?

Who is required to file Fannie Mae 3735?

How to fill out Fannie Mae 3735?

What is the purpose of Fannie Mae 3735?

What information must be reported on Fannie Mae 3735?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.